Zerodha’s Journey in Revolutionizing Retail Stockbroking in India

Zerodha stands out as one of the largest and most popular retail stockbrokers in India, offering discount brokerage services to retail investors and traders. With a staggering total of 5 million clients, of which 3.5 million are active, Zerodha commands a significant presence in the Indian stockbroking landscape, contributing to approximately 20% of retail trading turnover volumes in the country. Handling an average of 9-10 million transactions daily since its inception in 2010, Zerodha, founded by Nithin Kamath and Nikhil Kamath, has become synonymous with hassle-free online stock trading.

The name “Zerodha” itself is a blend of English and Sanskrit, combining “Zero” with “Rodha” (meaning Barriers or obstructions) to represent “No Obstructions,” encapsulating the essence of its mission. Its tagline, ‘The Free Trade Zone,’ succinctly underscores its commitment to brokerage-free trading, a significant draw for investors.

MARKETING STRATEGY

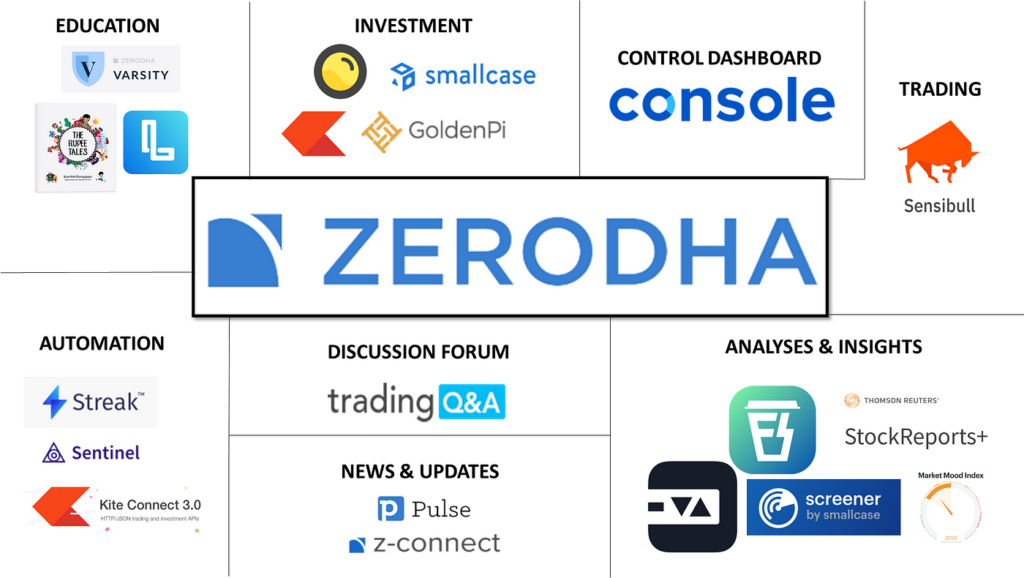

Zerodha maintains its competitive edge by keeping operational costs low through its online structure, offering a minimal fee of INR 20 per trade regardless of transaction size, along with a brokerage fee of 0.03% for commodity trading. Leveraging digital marketing, referral programs, and educational initiatives, Zerodha attracts and retains customers, complemented by robust customer service channels spanning over 120 branches and partner offices across India.

Zerodha’s strategic focus on low-cost, technology-driven, and customer-centric trading services underscores its commitment to empowering investors to make informed decisions. Products like Kite Connect API and user-friendly platforms like Kite for mobile and desktop ensure a seamless trading experience.

Rainmatter, Zerodha’s initiative providing funding and mentorship to startups in the financial ecosystem, aligns with its vision of fostering innovation. The Blue Ocean strategy, introducing discount brokerage costs and online financial literacy platforms, further cements its position as a leader in the Indian financial market.

Challenges for Zerodha

While Zerodha has experienced technical glitches, such as intermittent issues with order placement on the Kite app, the company promptly resolves such challenges. However, addressing customer queries effectively remains an area for improvement, despite initiatives like online ticketing and the ZPIN system to reduce waiting times.

To bridge the gap in equity research resources, Zerodha Varsity offers extensive educational materials, empowering investors with the knowledge needed for informed decision-making.

Future Plans of Zerodha

Looking ahead, Zerodha aims to eliminate barriers to trading and investing in India, emphasizing cost-effectiveness, robust support, and technological innovation. With the Zerodha Fund House, the company ventures into fund management, achieving a significant milestone of ₹ 500 crore AUM within three months.

Despite market fluctuations, Zerodha remains resilient, with a growing client base and a commitment to efficient customer support. With a focus on innovation and financial education, Zerodha is poised for a promising future, driving growth and empowering investors in India’s dynamic financial landscape.

For more interesting blogs visit: https://vichaardhara.co.in/