India’s Semiconductor Industry: Poised for Global Relevance

India’s semiconductor industry stands at a pivotal point, poised for substantial growth and global relevance. As the world increasingly relies on semiconductors for technological advancements, India recognizes the strategic importance of developing a robust semiconductor ecosystem. The government’s recent initiatives, such as the Production-Linked Incentive (PLI) scheme for the electronics sector, signify a strong commitment to fostering domestic semiconductor manufacturing.

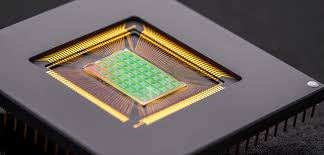

The India Semiconductor Mission

Launched in December 2021, the India Semiconductor Mission (ISM) aims to develop a robust semiconductor and display manufacturing ecosystem in India. The mission promotes chip manufacturing, design, and testing facilities, intending to make India a global semiconductor design and innovation hub. ISM seeks to attract investments, create job opportunities, and reduce import dependency. Key components include financial incentives, policy support, and collaboration with international semiconductor firms. This mission is crucial to India’s broader efforts to boost high-tech manufacturing capabilities and strengthen its position in the global electronics supply chain.

India as a Semiconductor Hub

Bengaluru, often referred to as the “Silicon Valley of India,” is the epicentre of India’s semiconductor industry. It hosts numerous semiconductor companies, research institutions, and tech parks. Notable companies include Tata Consultancy Services (TCS), primarily known for its semiconductor design services, and Bharat Electronics Limited (BEL), a major player in manufacturing. According to Union Minister Ashwini Vaishnaw, India is expected to be among the top five countries for semiconductor manufacturing within the next five years.

Revenue in the Indian semiconductors market is projected to reach $8.32 billion in 2024, with integrated circuits dominating the market. Major semiconductor manufacturing countries include the United States, Taiwan, South Korea, Japan, the Netherlands, and emerging producers like Germany. The marketing strategies differ significantly between mature markets like the US and Europe and emerging markets like India. While Western marketing focuses on high-tech industries and strict IP laws, Indian marketing emphasizes cost-effectiveness and local solutions, leveraging government initiatives like “Make in India.”

Challenges Facing India’s Semiconductor Industry

India faces several challenges in developing a comprehensive semiconductor industry. These include the lack of a robust and integrated supply chain, limited availability of raw materials, and a scarcity of semiconductor engineers with expertise in device physics and process technology. Additionally, India faces stiff competition from established semiconductor manufacturing hubs like China, Taiwan, and South Korea.

The high capital requirements for setting up fabrication plants, the need for advanced technology, and the long gestation period add to the financial burden. To address these issues, the Indian government has introduced the PLI scheme, fostering strategic global partnerships, and encouraging public-private collaborations. The industry also faces supply chain and geopolitical risks, highlighting the need for infrastructure development, regulatory streamlining, and policy support to attract both domestic and foreign investments.

Government Initiatives

The Indian government has approved three new semiconductor units under the initiative “Development of Semiconductors and Display Manufacturing Ecosystems in India.” These units, inaugurated in March 2024, aim to promote the electronics and hardware manufacturing industry.

Key government initiatives include:

- India Semiconductor Mission (ISM): Launched with an outlay of ₹76,000 crore for semiconductor manufacturing, packing, and design units.

- Design Linked Incentive (DLI) Scheme: Offers financial incentives and design infrastructure support for semiconductor design and development.

- Product Linked Incentive (PLI) Scheme: Encourages electronics manufacturing by providing production-based incentives.

- Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS): Supports the development of the semiconductor and display manufacturing ecosystem.

- Modified Electronics Manufacturing Clusters Scheme 2.0: Focuses on creating infrastructure and facilities for electronics manufacturing clusters.

These initiatives are expected to have a multiplier effect across different sectors of the economy, integrating India deeper into the global value chain. The government’s commitment, coupled with significant private sector investments, underscores the strategic importance of developing indigenous semiconductor capabilities.

Conclusion

India’s semiconductor industry is on the cusp of significant growth, driven by government initiatives, private sector investments, and strategic collaborations. With a focus on developing a comprehensive ecosystem, enhancing manufacturing capabilities, and fostering innovation, India is well-positioned to become a global leader in the semiconductor market. Continued investment in skill development and educational initiatives will ensure a skilled workforce, further strengthening India’s position in this critical industry.

India’s journey towards becoming a semiconductor hub will require perseverance, strategic planning, and a willingness to adapt. However, the potential rewards in terms of economic growth, job creation, and technological advancement make this endeavour a vital national priority.

For more such interesting blogs, visit https://vichaardhara.co.in/